Agentic Wallets & Passkey PRF: The Nuri.com Security Architecture

Executive Summary

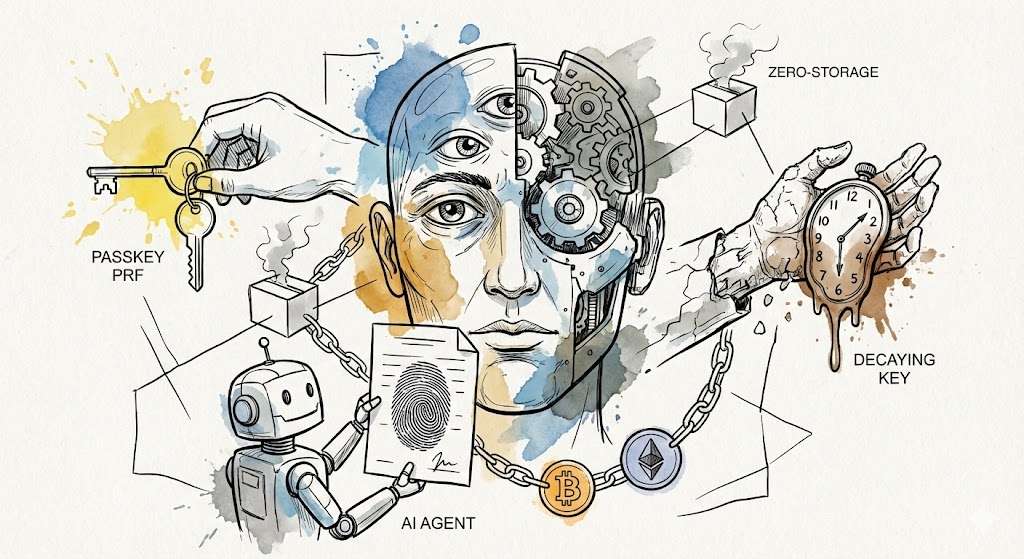

Traditional wallet security usually forces a trade-off between self-custody (seed phrases) and convenience (custodial). By leveraging the WebAuthn PRF (Pseudo-Random Function) extension, we have implemented a third way at nuri.com: A hardware-backed, deterministic, multi-sig wallet architecture designed specifically for the era of AI Agents.

1. The PRF Revolution: Hardware as the Seed

The core innovation lies in moving away from stored secrets. Instead of a master password or a stored JSON file, we use the Passkey PRF extension to derive entropy directly from the authenticator (e.g., TouchID, FaceID, or YubiKey).

- Deterministic Output: Every time the user authenticates, the PRF extension produces the exact same output for a given input/salt.

- The “Zero-Storage” Model: $Seed = \text{HMAC-SHA256}(\text{AuthenticatorSecret}, \text{Salt})$ Because we can re-derive this $Seed$ at any time, the private keys are generated on-the-fly and zeroized (wiped) immediately after the signature is produced.

2. Decaying Multi-Sig: The Ultimate Fail-Safe

To balance security with availability, we utilize a Decaying Multi-Signature script.

- Active State: Requires 2-of-2 signatures (The PRF-derived key + a Service-backed key).

- Decay Mechanism: If the service (Relying Party) becomes unavailable or the domain is lost, a time-lock (CheckSequenceVerify) allows the wallet to transition into a 1-of-1 state.

- Outcome: The user is never locked out of their funds by a service provider, yet enjoys the security of co-signing during normal operations.

3. The “Agentic Wallet” Paradigm

As AI agents begin to handle on-chain logic, the bottleneck becomes Authorization vs. Execution.

How it works with Agents:

- Preparation: An AI Agent monitors the chain and prepares a complex transaction (e.g., “Rebalance my DeFi positions if gas is low”).

- Orchestration: The Agent handles all the “legwork” and presents a ready-to-sign payload to the user.

- Biometric Co-signing: Because the private key requires a biometric trigger via the Passkey PRF, the Agent cannot spend funds autonomously.

- Security: This creates a hardware-bound guardrail. The Agent is the “pilot,” but the User’s thumbprint is the “ignition key.”

4. Cross-Chain Versatility

While many Passkey implementations focus solely on EVM (via ERC-4337), our setup at nuri.com is chain-agnostic. By deriving a master seed, we support:

- Bitcoin: Native SegWit/Taproot transactions via deterministic BIP32 derivation.

- EVM: Full compatibility with Ethereum-based chains and Account Abstraction.

5. Conclusion: Why this matters

This setup moves us toward a “Secretless” future. There is no seed phrase to lose, no master password to phish, and no service provider that can freeze your funds indefinitely. By open-sourcing this orchestration logic, we aim to provide the foundational layer for secure, human-in-the-loop Agentic Wallets.

Post created via email from emin@nuri.com